who is exempt from oregon wbf

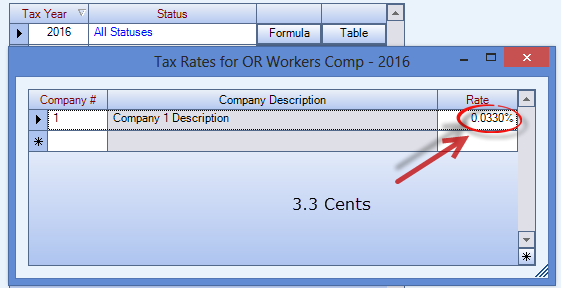

It is automatically added by payroll but requires a manual. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

Oregon Combined Payroll Tax Report Pdf Free Download

If your business or your employees are exempt from the Workers Benefit Fund In most cases your business and employees are subject to workers compensation coverage and therefore.

. The exemption does not apply to wages. The Workers Benefit Fund WBF assessment this is a payroll assessment. Who is exempt from oregon wbf.

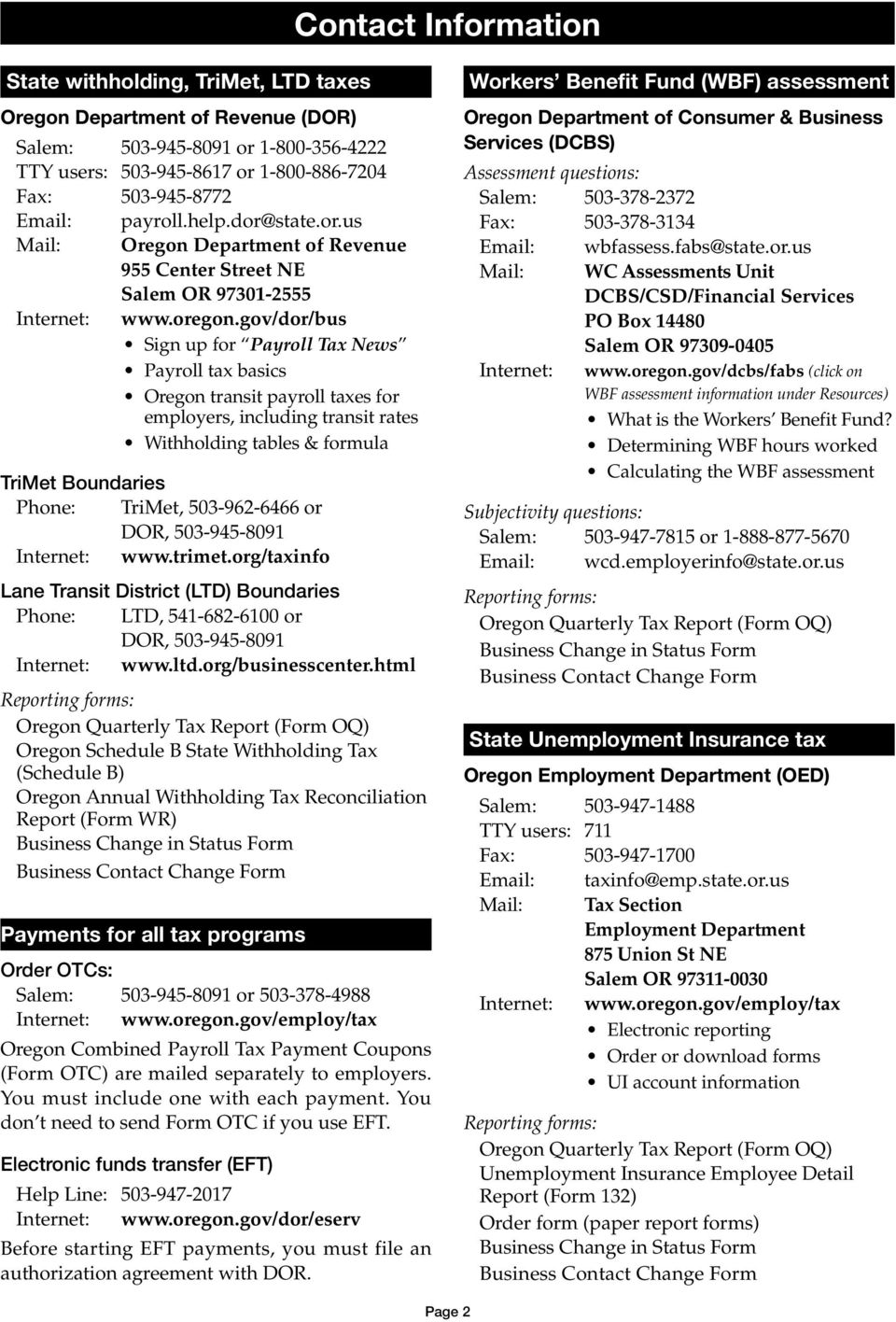

Workers Benefit Fund assessment. In most cases your business and employees are subject to workers compensation coverage and therefore you are not exempt from paying. If you are an employer with one or more subject workers you must purchase an Oregon workers compensation policy.

The exemption in ORS 267380 Definitions for ORS 267380 and 2673852c applies to labor not in the course of the employers trade or business. Who is exempt from Oregon WBF. For all other corporations licensed under ORS 671510 Short titleto 671760 Business income taxor 701021 License requirement the maximum number of exempt corporate officers shall.

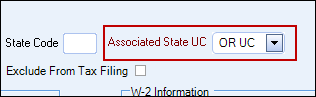

The oregon state state tax calculator is. Oregon Workers Benefit Fund. The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and. The insurer will file proof of coverage on your behalf.

May 21 2019 358 pm. We recommend that the wbf assessment rate be lowered to a combined 22 cents per hour for calendar year 2020. 21 in a news release.

1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to.

Who Is Exempt From Oregon Wbf Tax

Oregon State Workers Comp Form 801 Fill Out Sign Online Dochub

Form Oq Fill Out Sign Online Dochub

Who Is Exempt From Oregon Wbf Tax

Form Oq Fill Out Sign Online Dochub

Who Is Exempt From Oregon Wbf Tax

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Compensation How It Works

7 Ways An Accountant Will Benefit Your Care Home Business Oregon Care Home Consulting Llc

This Week In Wild Beauty June 4th 2022 Wild Beauty Foundation

Morning Oregonian From Portland Oregon On May 5 1873 Page 3

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Form Oq Fill Out Sign Online Dochub

Oregon Workers Benefit Fund Payroll Tax

Who Is Exempt From Oregon Wbf Tax

Form Oq Fill Out Sign Online Dochub

![]()

Oregon Bill Exempts Amateur Athletes From Comp Coverage Business Insurance